Ex Government Employee Retirement Compensation

2

Q Tbn 3aand9gct9yhshn4m Gl1ypnd 5 G525cxvlflu0qffpsuwoiavzhszswj Usqp Cau

Www Calpers Ca Gov Docs Forms Publications State Health Guide Pdf

The Impact Of Separation Annulment Or Divorce On Your Benefits

Publication 957 01 13 Reporting Back Pay And Special Wage Payments To The Social Security Administration Internal Revenue Service

Dismissal Employment Wikipedia

The plan will have a qualification failure unless it uses the statutory definition of compensation for these limits and minimums (see Code Sections 415 and 416.) Tips to avoid compensation-related failures.

/social-security-survivor-benefits-for-a-spouse-2388918-v3-5bc644f846e0fb0026f5c3e2.png)

Ex government employee retirement compensation. Pay Scales for Federal Employees. The final divorce agreement has to include a court order stating that the employee gives up a share of. Catch-up contributions may also be allowed if the employee is age 50 or older.

The South Carolina Deferred Compensation Program (Deferred Comp) offers a unique opportunity for you to save for your future. Retirement Does Not End Payment of Medical Bills Related to a Work Injury. • Unable to work due to illness or injury (unrelated to work).

COMPENSATION FOR EX-MINEWORKERS FACT SHEET The Financial Services Board (FSB) is an independent institution established by statute to oversee the South African NonBanking Financial Services Industry in the - public interest. A former employee may be prohibited from accepting compensation from a contractor if the former employee served in a Government position or made a Government decision involving more than $10,000,000 given to that contractor. Survivors – When a Federal employee dies, monthly or lump sum benefits may be payable to survivors.

By choosing to contribute a portion of your salary. Beneficiaries/QDRO or other recipients of benefits after retirement:. Workers’ comp pays for medical bills and time off from work, among other things.

Former Boeing or Subsidiary* Employees who left the Company before January 1, 11;. Every civilian employee of the federal government, including employees of the executive, legislative, and judicial branches, is covered by FECA, as are. Learn more about the FederalPay Employees Dataset here.

Keeping your Federal Employee Health Benefits (FEHB) in retirement is possible, but you have to meet certain criteria to be eligible. Former federal government employees received $22,669. Eligible active executive level employees, former executive level employees who on or after January 1, 07 were reduced to a classified position after having obtained the age of 55 and 10 years of eligible service, and former executive level employees who, in each case, have separated from service and are otherwise eligible, shall be referred.

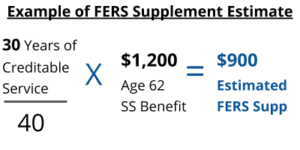

It was meant to replace the Civil Service Retirement System that federal employees participated in before 1987. The elective deferral limit for SIMPLE plans is 100% of compensation or $13,500 in , $13,000 in 19 and $12,500 in 18. FERS was created by the US Congress in 1986 and became effective at the beginning of 1987.

It was created in 1944 and is governed by Vermont Statute Title 3, Chapter 16. The benefit provided by TCRS is a solid foundation for building a retirement future. FederalPay provides this data in the interest of government transparency — employee data may not be used for commercial soliciting or vending of any kind.

Pay tables for federal employees ( and prior years). • Employee must be on the payroll (including “leave without pay”) to be eligible to file. Government Executive is the leading source for news, information and analysis about the operations of the executive branch of the federal government.

Use the statutory definition of compensation when required. The government publishes new pay tables for federal employees every year. In 1987, the Federal Employees’ Retirement System (FERS) replaced that plan.

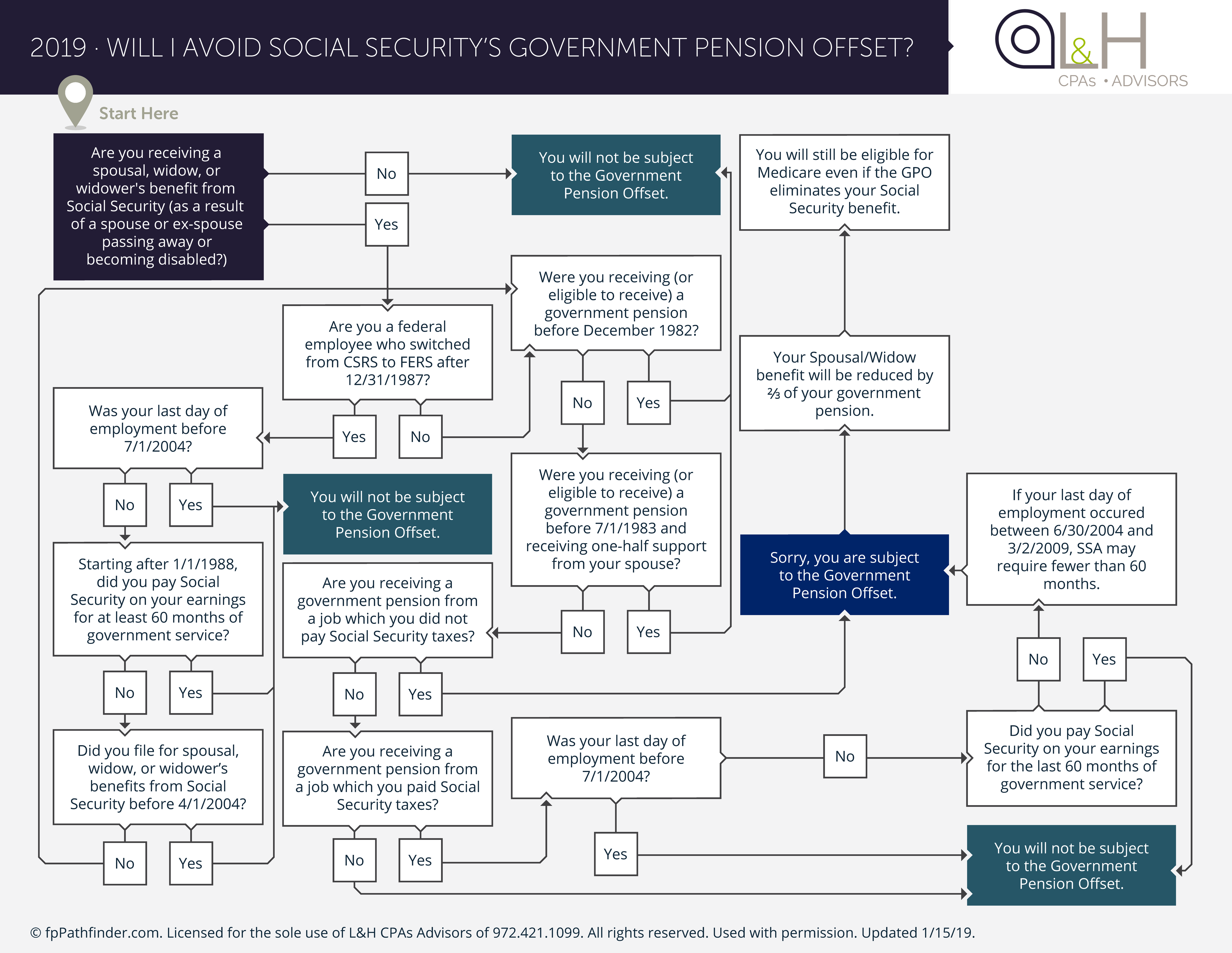

FERS is comprised of Social Security, basic annuity and the Thrift Savings Plan investment account. Benefits you are eligible to receive based on your own earnings record may be affected by a different rule called the Windfall Elimination Provision (WEP). The Federal Employees’ Compensation Act (FECA) is the workers’ compensation program for.

Its mission and vision are to promote and maintain a sound financial investment in South Africa. Deferred Comp is available to most members covered by the South Carolina Retirement Systems, and Empower Retirement administers the program. 50% of the employee’s final salary (average salary, if higher), plus.

Federal employee salaries are public information under open government laws (5 U.S.C. When FERS began, CSRS workers could switch to FERS. $15,000 increased by Civil Service Retirement System (CSRS) cost-of-living adjustments beginning 12/1/87.

As a Federal employee, you and your family have access to a range of benefits that are designed to make your. • No age requirement. If you leave your Government job before becoming eligible for retirement:.

Civil Service Retirement System (CSRS) for Employees Hired Before October 1, 1987:. The plan covers all employees in the executive, judicial, and legislative branches of the. Employee has Right to take Retirement:.

While a pension and/or Social Security may go a long way, they may not be enough. Deferred – If you are a former Federal employee who was covered by the Federal Employees Retirement System (FERS), you may be eligible for a deferred annuity at age 62 or the Minimum Retirement Age (MRA). However, injured workers should know how retirement affects their workers compensation rights before making this important decision.

By September 17, nearly 600,000 (around 31 percent) will be eligible to retire, government-wide. CSRS-covered employees who separated from the District and return to District service after April 1, 1986 must pay the Medicare tax (currently 1.45 percent of pay). After a five-year vesting period, an employee becomes eligible to receive a monthly benefit at retirement once the age requirement is met.

What Retirement Plan Options Do Congressmen Have?. Durban – A former government employee says missing documents from the KwaZulu-Natal Department of Cooperative Governance and Traditional Affairs (Cogta) has caused issues with her pension payout. Among them are the right to disclosure of important plan information and a timely and fair process for benefit claims.

2.2 Specifically, the directive and Appendix B – Salary Elements of Executive Compensation apply to excluded employees in the following groups and levels:. Even if an employee retires, the workers. If you are a former Boeing or Subsidiary* employee who has left the company before Jan.

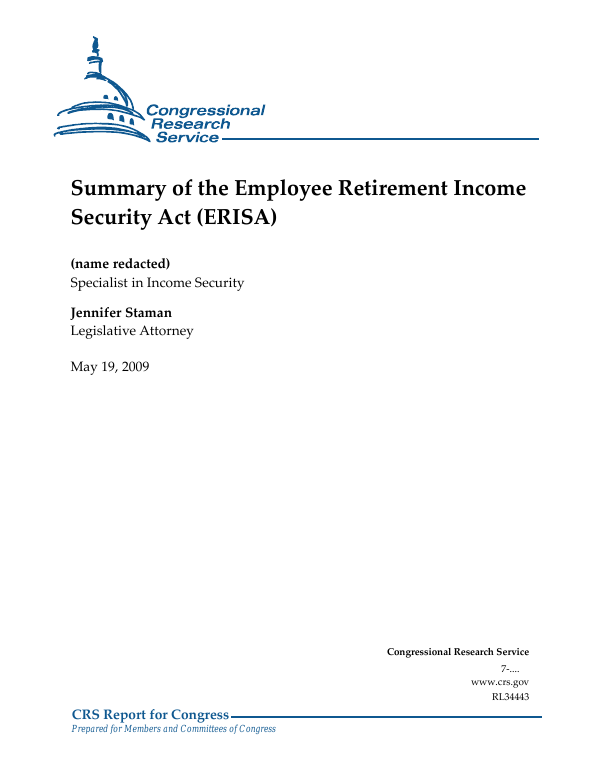

Information about the pension plan for active or retired public service employees and their survivors or dependants, retirement income sources and pension options. It is a straightforward way to work toward the retirement income you desire. Employees participating in retirement plans have several important rights under the Employee Retirement Income Security Act (ERISA).

CSRS-covered employees contribute 7, 7.5 or 8 percent of pay to CSRS. Learn more about the TCRS Login to TCRS Self. The benefit is calculated by the employee’s years of service and salary.

If the employee became a member on or after January 1, 13, they must be at least 52 years old to retire. (11) Payments paid to an employee or employee representative which are subject to tax under section 31(a) or 3211(a) of the Internal Revenue Code of 1954 are creditable as compensation under the Railroad Retirement Act for purposes of computation of benefits under sections 3(a)(1), 3(f)(3), 4(a)(1) and 4(f)(1). Retirement plans established for the benefit of governmental employees generally function in ways similar to those covering private employers.

The mainstream advice about 401(k) plans and Social Security benefits doesn’t apply to you. However, in many cases, different Sections of the Internal Revenue Code determine the tax treatment of these plans. Spending on total government-wide compensation for each full-time equivalent.

You will find our comprehensive compensation and benefits package to be competitive. You can ask that your retirement contributions be returned to you in a lump sum payment, or. The Administrative Reforms Commission had recommended in its report on Personnel Administration, as follows.

Retirement planning is different if your career has been as a government employee. Federal Employee Compensation Package:. The Federal Employees Retirement System, or FERS, is the retirement plan for all U.S.

Under this defined benefit plan, both employees and the State contribute to a trust fund. Our employees are enthusiastic, talented and diverse, committed to working smart and providing the best customer service possible. If you worked for the civil service or postal service for at least five years before leaving, and didn't withdraw your funds, you can either collect a FERS annuity at the ages specified in the above chart as early as age 60 with years service or age 62 with 5 years of service or accept a lump sum payment.

Federal Employees Retirement System participants younger than 62 years of age earn 60 percent of their high-three salary, though after 12 months, benefits drop to 40 percent. Service retirement or "normal" retirement;. Ordinary Disability Retirement • 10 or more years of service.

Saving to your 457(b) plan can help you maintain your desired standard of living. About Us The North Carolina Retirement Systems is a division of the Department of State Treasurer, and we administer the pension benefits for state and local government employees. The Vermont State Retirement System (VSRS) is the public pension plan provided by the State of Vermont for State employees.

GEPF is a defined benefit pension fund that was established in May 1996 when various public sector funds were consolidated. 0 Current Employees The total number of active and former public employees who are or have contributed money to the pension systems (as of October ). In these situations, the Government Pension Offset rule may reduce the Social Security benefits you are eligible to receive as a spouse, ex-spouse, or as a widow or widower.

The Civil Service Retirement Spouse Equity Act of 1984 (Public Law 98-615) was enacted on November 8, 1984. 1, 11, or you are a Beneficiary or QDRO, you must update your address directly with the Benefit Suppliers. The government doesn't automatically grant the ex rights to the federal employee's benefits.

Service retirement is a lifetime benefit. (For more information, see Worker’s Compensation for Federal Government Employeess.) The Office of Personnel Management (OPM), on the other hand, is the federal agency that administers disability retirement benefits for employees of the federal government. (See also, 6 Surprising Facts About.

Department of Labor's Office of Workers' Compensation Programs (OWCP) administers four major disability compensation programs which provides to federal workers (or their dependents) and other specific groups who are injured at work or acquire an occupational disease – providing the injured:/p> Wage replacement benefits Medical treatment Vocational rehabilitation Other benefits Other. The History of FERS. We have more than 1.2 million active members, in excess of 450 000 pensioners and beneficiaries, and assets worth more than R1.8 trillion.

Prior to 1984, the Civil Service Retirement System (CSRS) covered all senators and representatives. A former employee may be prohibited from sharing in profits earned by others if the money was earned from having contact with the Government on behalf of third parties (e.g., clients) while the former employee was still in Government. Depending on the statutory basis for the plan and how it operates, employer and employee contributions may be subject to Federal income.

Pay for Government of Canada employees and tools to ensure timely and accurate processing. Rather, section 7 prohibits a former employee from providing certain services to, or on behalf of, non- Federal employers or other persons, whether or not done for compensation. In most cases, the employee can retire as early as age 50 with five years of service credit.

2.3 Appendix C – Non-Salary Elements of Executive Compensation applies to excluded employees in the following groups:. The 457(b) Deferred Compensation Plan is one piece of your retirement program designed to supplement your retirement savings. Supplemental Retirement/Deferred Compensation The State offers low-fee, tax-deferred programs to provide a way to save money to supplement the state retirement plan.

If the employee's total contributions exceed the deferral limit, the difference is included in the employee's gross income. FECA benefits after retirement age, the overall level of FECA disability benefits as compared. The Government Employees Pension Fund (GEPF) is Africa’s largest pension fund.

Under this act, as amended, certain former spouses of Federal employees, former employees, and annuitants may qualify to enroll in a health benefits plan under the FEHB Program. We foster this environment through employee recognition programs, merit-based awards and by providing competitive compensation with rich benefits. A nonqualified deferred compensation (NQDC) plan is a broad, general description for any arrangement under which the employer or the employee can defer taxation of compensation that is earned in one year so that it becomes included in taxable compensation in a later year (because payment occurs more than 2 ½ months after the year in which the.

It is important for employees and their families to know their benefit rights to make their benefits work for them. You're making a great choice when you choose a career with the Federal Government. For deaths on or after 12/1/16, this amount is $32,423.56.

Foreign Service pay tables. Public service pension plan. In 15, the median pension and annuities received by former employees at private companies was $9,376.

At ETF, our strength is our employees. To learn more about 401(k) and Roth Savings Plans and 457 Savings Plans, visit the Retirement and Savings page on the State Treasurer's website. The 1.96 million permanent career employees on board as of September 12, nearly 270,000 (14 percent) were eligible to retire.

The president and Congress decide how much, if any, pay raise federal workers will receive in the next calendar year. It's More than Just Salary. Amount of Basic Employee Death Benefit.

If you have at least five years of creditable service, you can wait until you are at retirement age to apply for monthly retirement benefit payments. The Government has extended facility to Government servants to take retirement from service voluntarily with full pensionary benefits before attaining the age of superannuation. Learn about our Employer Contributions.

Retiring does not mean an employee gives up all of his or her workers compensation rights.

Www Sec Gov Comments S7 45 10 S 554 Pdf

/social-security-ex-spouse-2388947_V3-49a27ada826c4b8a84d087f7178b9e84.png)

Social Security Benefits For An Ex Spouse

Options For Retirement Perspective

Railroad Retirement Board Wikipedia

A Tale Of Two Retirements One For Ceos And One For The Rest Of Us Center For Effective Government

Publication 575 19 Pension And Annuity Income Internal Revenue Service

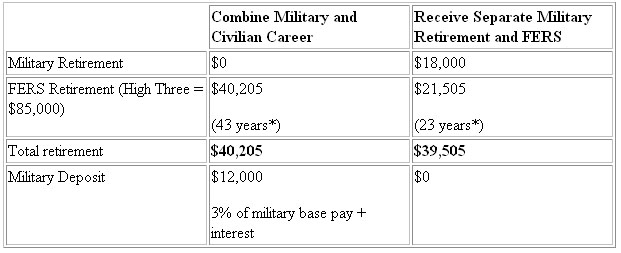

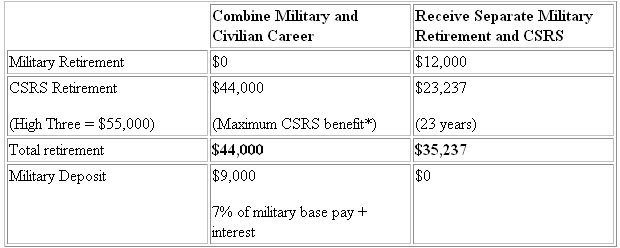

Mixing Civilian And Military Retirement Government Executive

:max_bytes(150000):strip_icc()/1918917v1-5ba51fa146e0fb00258f5c79.png)

Retirement Letter Sample To Notify Your Employer

Q Tbn 3aand9gcqbqgy8ajvtswxk8v4dn Edzll3medo1h1rhbj0hnm3npi7pw3p Usqp Cau

Top Retirement Strategies For Government Employees

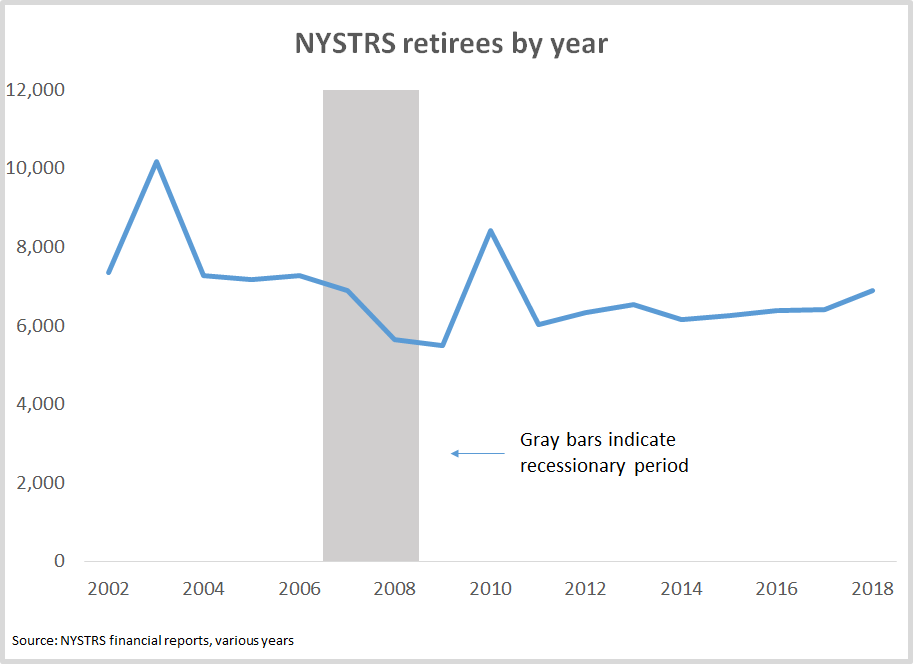

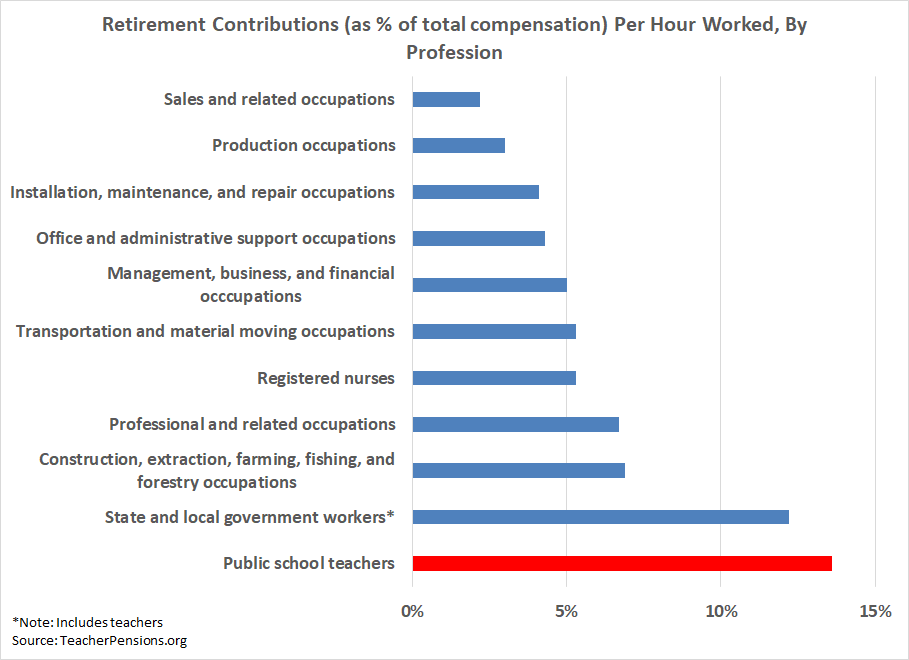

Teacher Pensions Blog Teacherpensions Org

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How Are Spousal Benefits Calculated For Social Security

Social Security Benefits For Children The 4 Most Important Things You Should Know Social Security Intelligence

Ex Officer Accused Of Murdering Floyd Could Get 50 000 Annual Pension The New York Times

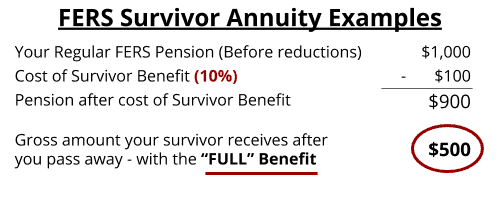

Fers Survivor Benefits Plan Your Federal Retirement

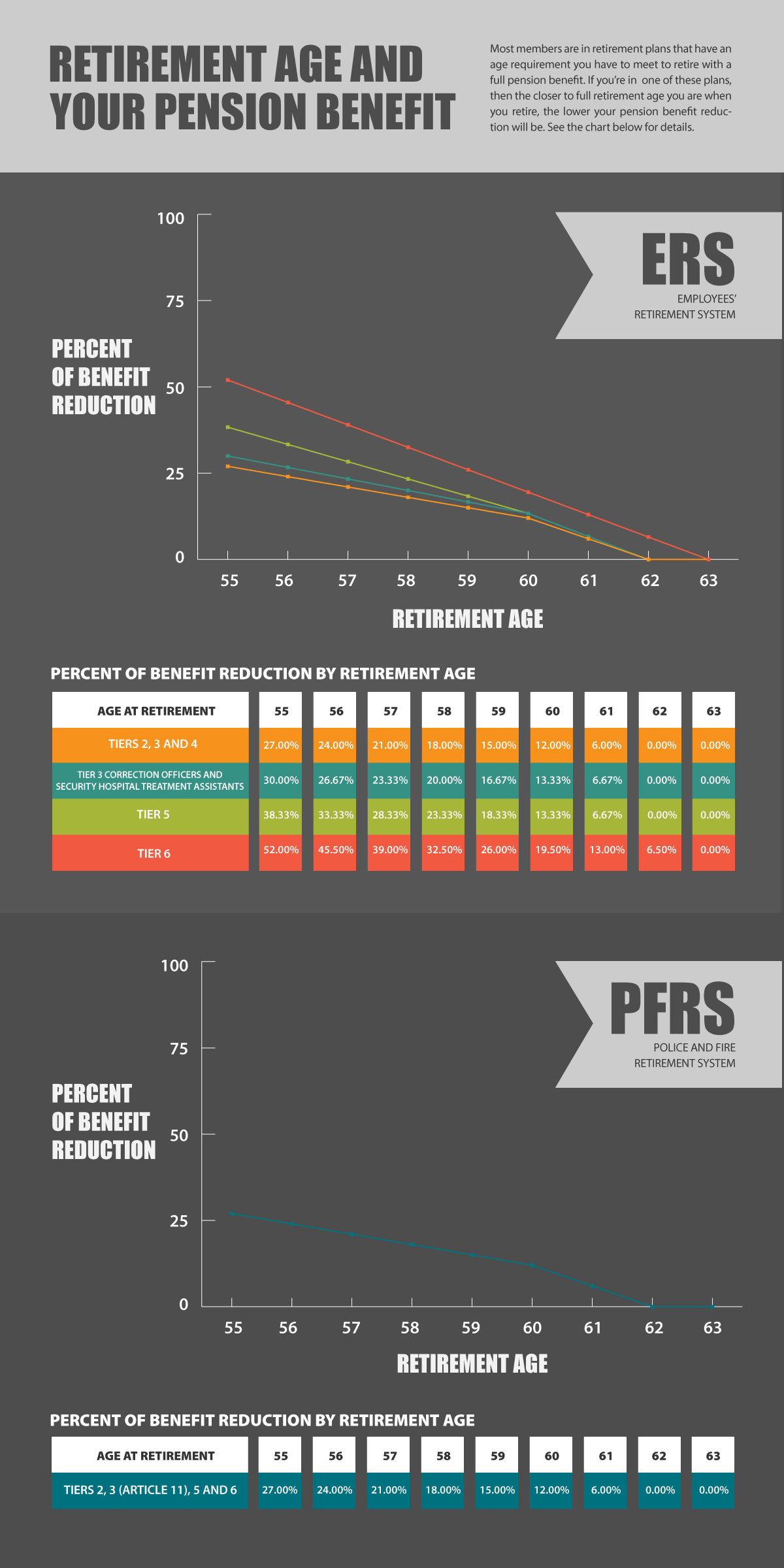

Will Your Retirement Age Affect Your Benefit New York Retirement News

Etf Wi Gov Publications Et2119

2

Arizona State Retirement System Your Money Your Future Secure For Your Lifetime

Total And Partial Unemployment Tpu 460 55 Pension Or Retirement Pay

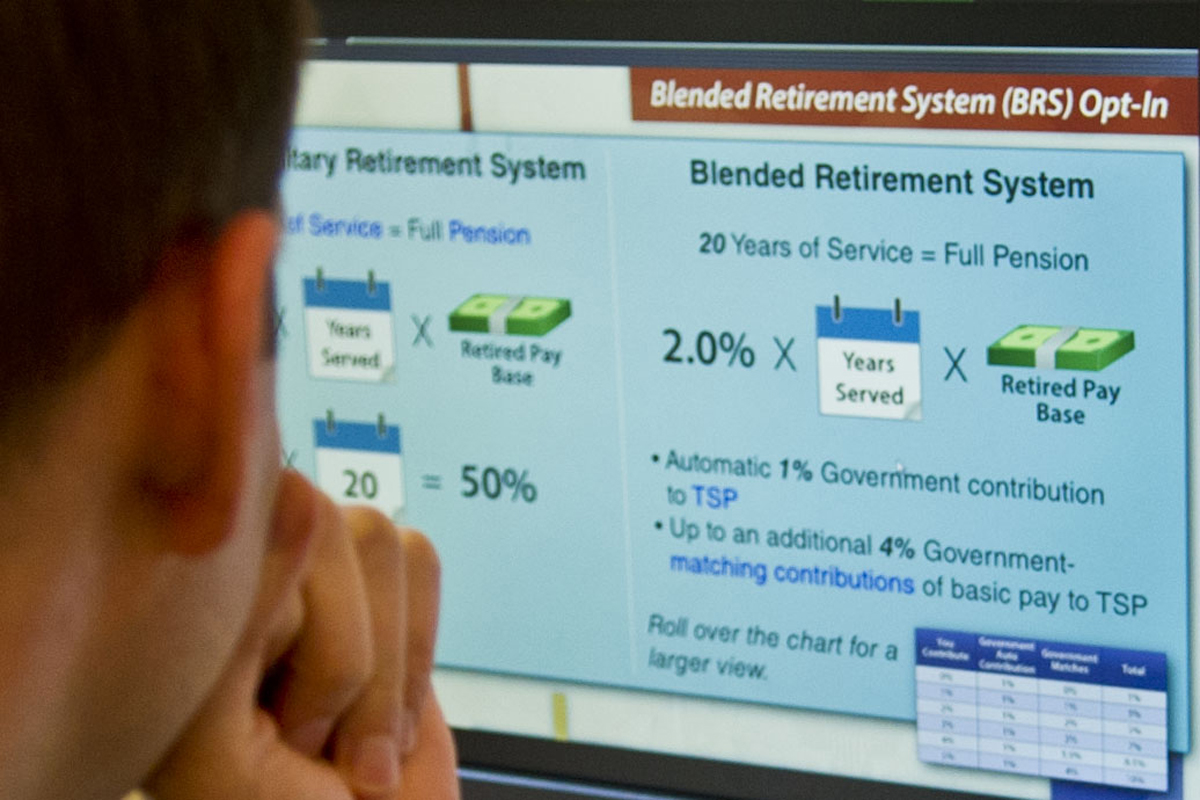

The Blended Retirement System Explained Military Com

A Tale Of Two Retirements One For Ceos And One For The Rest Of Us Center For Effective Government

Receiving A Civil Service Pension And Social Security

Retirement Services Opm Gov

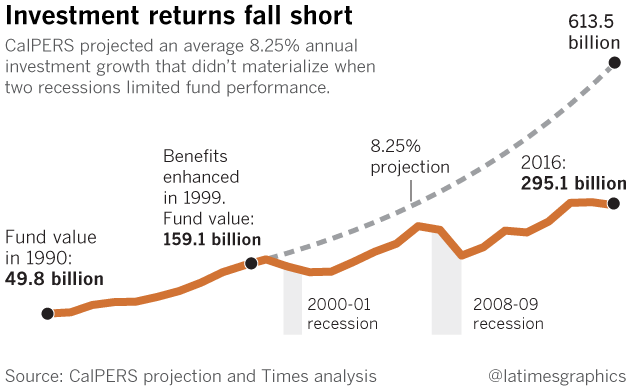

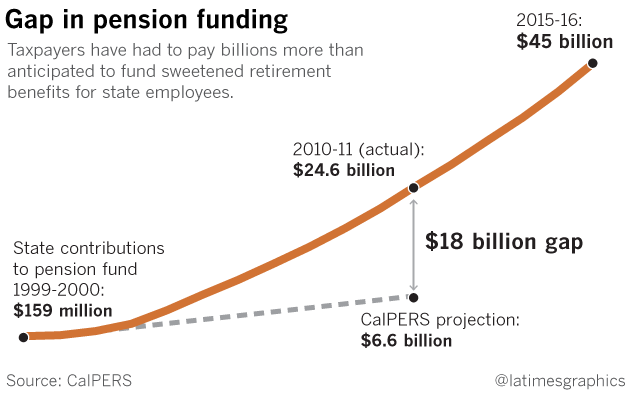

How A Pension Deal Went Wrong And Cost California Taxpayers Billions Los Angeles Times

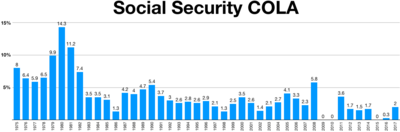

Social Security United States Wikipedia

Revision Of Pension For Bsnl Employees Retiring Between Pages 1 4 Text Version Fliphtml5

2

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-748d66dee7454c33907bb46cc5951803.png)

What Happens To Your Pension When You Leave A Company

Everything You Need To Know About Your Chevron Pension Plan Techstaffer

Benefits Fiu Human Resources

Return To Work Laws My Nc Retirement

1

/retirement-letter-sample-1918917-Final22-afb35717d27e42b4abe8bfb03105585e.png)

Retirement Letter Sample To Notify Your Employer

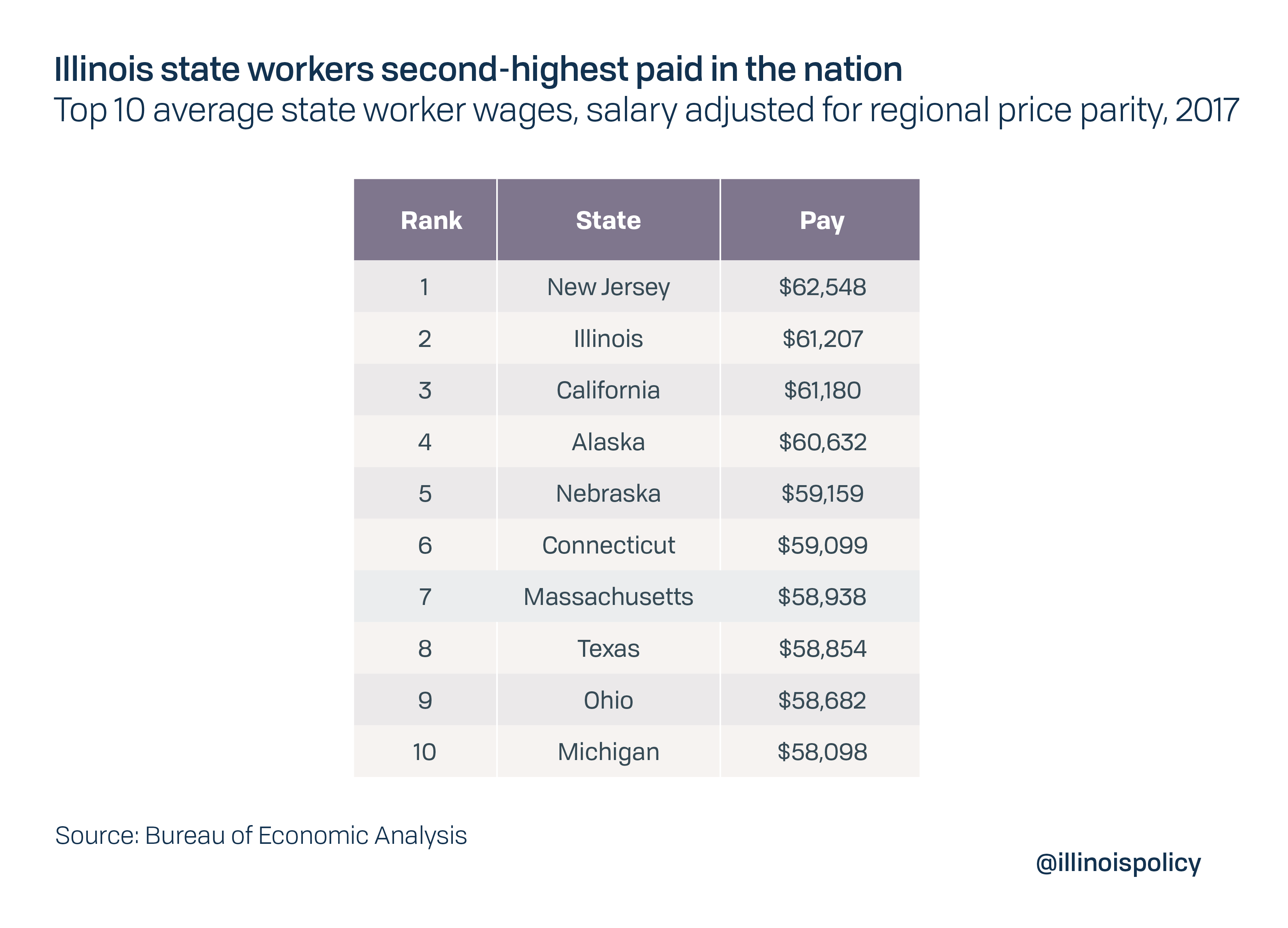

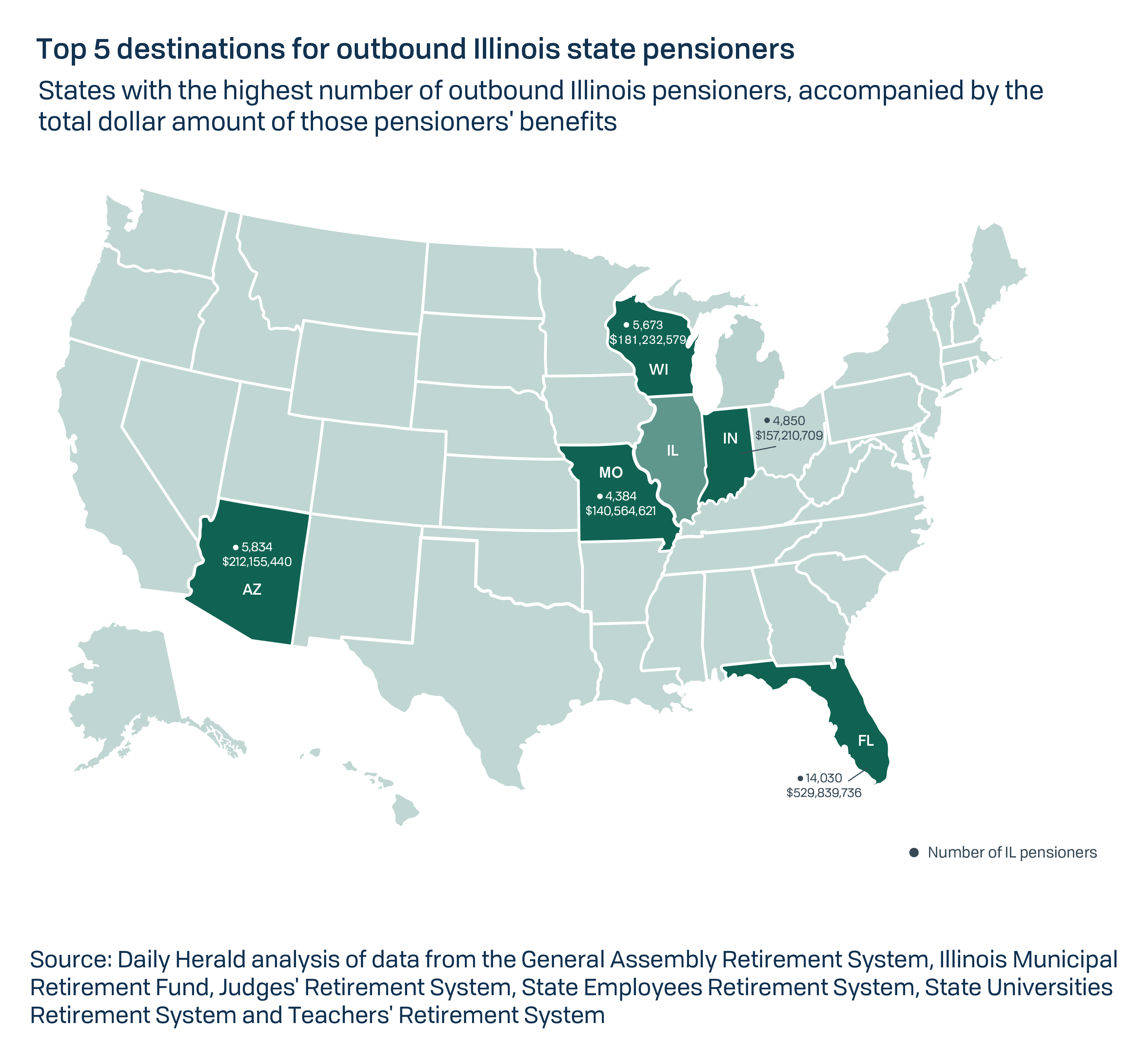

The Illinois Pension Disaster Crain S Chicago Business

Everything You Need To Know About Social Security Retirement Benefits Simplywise

The Guide To Social Security Spousal Benefits Simplywise

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-595348697-57cf02743df78c71b6641543.jpg)

Government Pension Offset How It Affects Your Benefits

The Guide To Social Security Spousal Benefits Simplywise

How A Pension Deal Went Wrong And Cost California Taxpayers Billions Los Angeles Times

Pay Statement Explained Opa

Usajobs Help Center Federal Employees

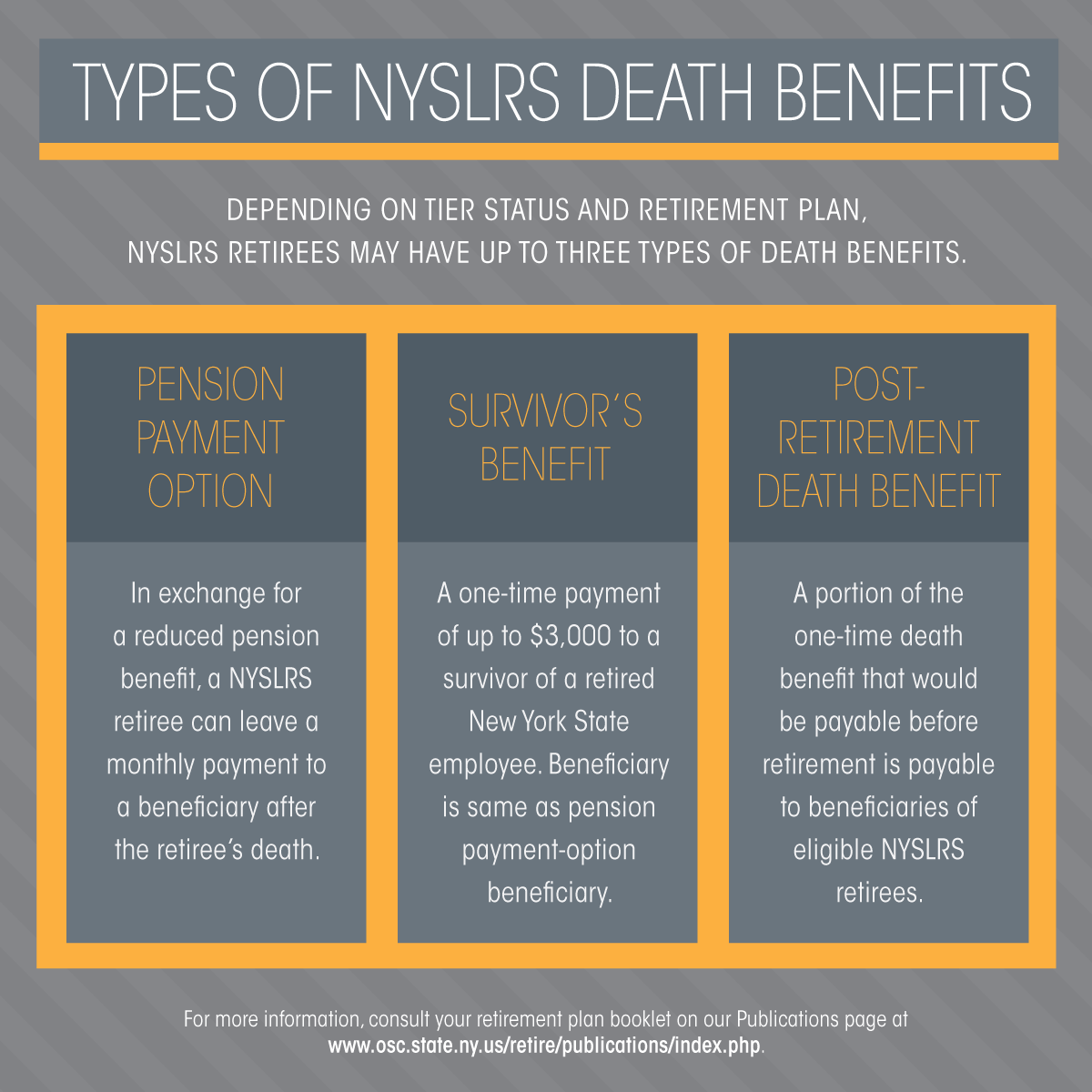

Death Survivor Benefits The Western Conference Of Teamsters Pension Trust

State Retirement Plans And Divorce Pension Rights Center

C5hfizry5ocdrm

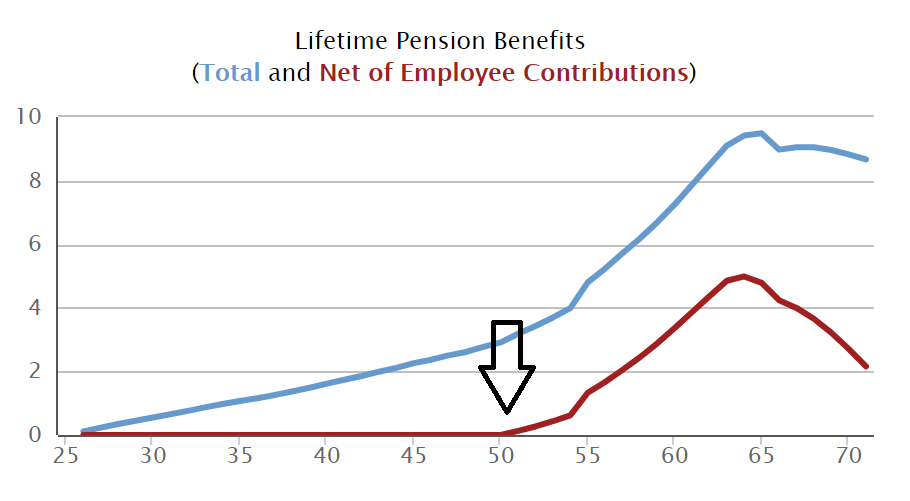

Teacher Pensions Blog Teacherpensions Org

Social Security Issues Facing Federal Employees Working Past Age 65

What Is The Federal Employees Retirement System Fers And How Does It Work

Mixing Civilian And Military Retirement Government Executive

California Supreme Court Upholds Pension Spiking Ban

Everything You Need To Know About Your Chevron Pension Plan Techstaffer

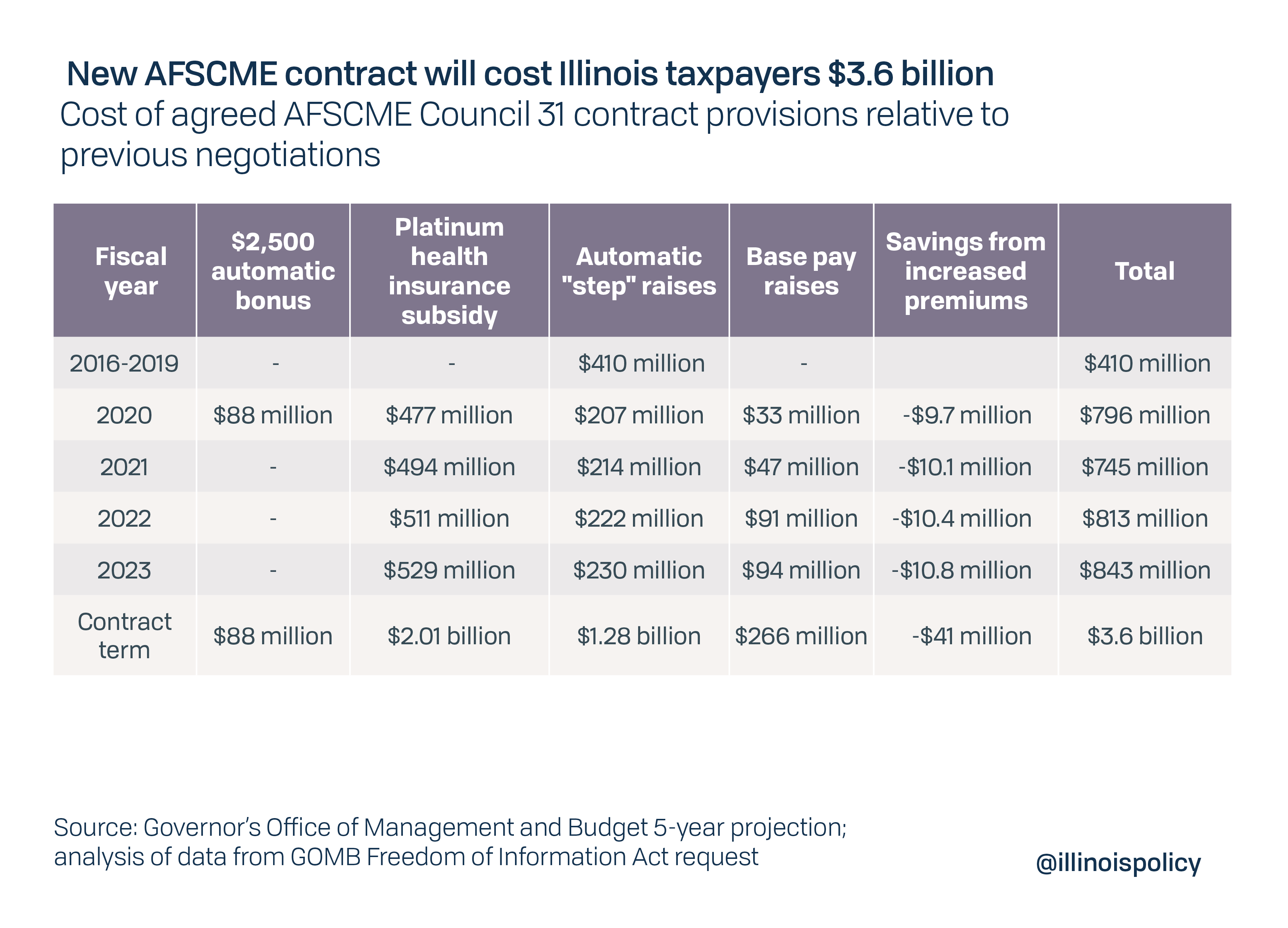

Pritzker S Afscme Deal Gives 12 Automatic Raises 2 500 Bonus To State Workers

Benefits For Survivors My Nc Retirement

Married Women S Projected Retirement Benefits An Update

Everything You Need To Know About Social Security Retirement Benefits Simplywise

If You Worked For The Federal Government Texas Workforce Commission

Will You Avoid Social Security S Government Pension Offset

Member Handbooks My Nc Retirement

A Tale Of Two Retirements One For Ceos And One For The Rest Of Us Center For Effective Government

Fers Supplement Plan Your Federal Retirement

A Tale Of Two Retirements One For Ceos And One For The Rest Of Us Center For Effective Government

10 Most Commonly Offered Employee Benefits

1

Welcome To Opers Oklahoma Public Employees Retirement System

Your Retirement Benefits Modot Patrol Employees Retirement System

Ers Texas Gov Contact Ers Additional Resources Guides And Handouts Retirement Planning Your Retirement For Cpos Cos Pdf

/social-security-survivor-benefits-for-a-spouse-2388918-v3-5bc644f846e0fb0026f5c3e2.png)

Social Security Survivor Benefits For A Spouse

Wisersageprotectingfinancesindivorce16 By Sage Issuu

Report What Happens To Your Federal Employee Benefits In Divorce

Pritzker S Afscme Deal Gives 12 Automatic Raises 2 500 Bonus To State Workers

5 Things A Widow Or Widower Would Tell You About Fers Survivor Benefits A Common Question Fedsmith Com

/how-the-the-social-security-spouse-benefit-works-2388924-Final-454c6b7b12a44930bd8ab9c5d81a6102.png)

Social Security Spousal Benefits What You Need To Know

Summary Of The Employee Retirement Income Security Act Erisa Everycrsreport Com

Details About The Mfpf The Modified Former Pension Formula Benefit

Death Survivor Benefits The Western Conference Of Teamsters Pension Trust

How To Keep Your Fehb Health Insurance When You Retire Fedsmith Com

Retirement Frequently Asked Questions Human Resources

Is There Any Apple Government Employee Discount Things You Must Know

10 Myths And Misconceptions About Social Security

Department Of Human Resources Development Employee Benefits

Verify Are White House Employees Guaranteed Benefits For Life Wusa9 Com

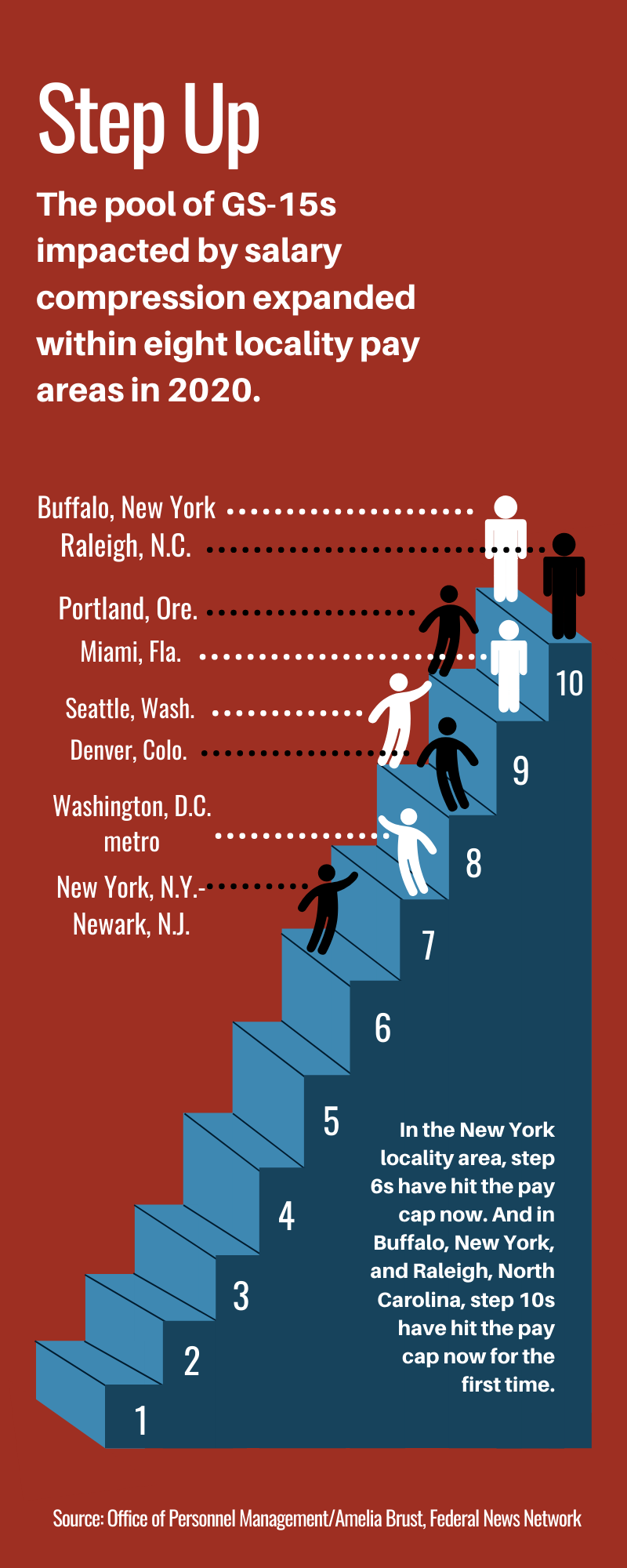

More Top Career Employees Hit The Federal Pay Ceiling In Federal News Network

Social Security Administration S Master Earnings File Background Information

Retirement Money For Ex Presidents How Much Will Obama Get

Social Security United States Wikipedia

Pension Rights After Divorce Pension Rights Center

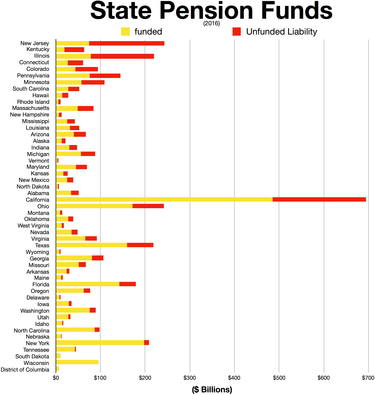

Public Employee Pension Plans In The United States Wikipedia

Pritzker S Afscme Deal Gives 12 Automatic Raises 2 500 Bonus To State Workers

Teacher Pensions Blog Teacherpensions Org

How A Pension Deal Went Wrong And Cost California Taxpayers Billions Los Angeles Times

Some L A Pensions Are So Huge They Exceed Irs Limits Costing Taxpayers Millions Extra Los Angeles Times

Files Nc Gov Retire Documents Files Tsershandbook Pdf

:max_bytes(150000):strip_icc()/GettyImages-157422696-91d9faa2445f43fd95062873356b57bc.jpg)

8 Types Of Americans Who Aren T Eligible To Get Social Security

Can I Change My Beneficiary After I Retire New York Retirement News

Social Security Sers

/understanding-military-retirement-pay-3332633_final-e2d76ea63bda4604973777b1b3d9d9b2.png)

Understand The Military Retirement Pay System

Death Survivor Benefits The Western Conference Of Teamsters Pension Trust

Nc 401 K Plan Nc 457 Plan And Nc 403 B Program Supplemental Retirement Plans My Nc Retirement